The Difference Between Secured Versus Unsecured Debt

The chance of you needing to borrow money at some point in your life is pretty great. However, not every type of debt is going to be bad for you. For example, it can be pretty hard to buy a home without taking on some kind of debt. There are two types of debt. When you need to borrow money, it’s important to know what kind of debt you are taking on and if that debt is unsecured or secured debt.

There are big differences between the two categories of debt in terms of the risk you are taking and the amount of interest you are going to pay. Before you take on any debt, learn the differences between secured versus unsecured debt.

Collateral

The main difference between secured versus unsecured debt is actually just one word: collateral. If the debt is secured then there is something that acts as collateral. If the debt is secured then it means that the lender practically has a guarantee that the debt will be repaid. If you don’t repay your secured debt, the lender can take the collateral and resell the asset to recoup money that was loaned out.

If it’s an unsecured debt then there won’t be any collateral. The only thing that guarantees that you will repay the debt is your promise. If you break this promise then the lender doesn’t have a lot of options. The lender can take you to court or get a judgment against you. This will also cost the lender money and there won’t be a guarantee that you would even have the cash to pay for it all, even after they take these steps. There is a lot of risk for the lender when it comes to unsecured debt. There is less risk for borrowers who take on unsecured debt since there’s no quick process for your asset to be taken away if you aren’t paying.

Two Types of Secured Debt

You will find both consensual and non-consensual loans. Consensual loans are a common type of secured debt, where you agree to put up your property as collateral. There are many types of non-consensual loans as well. Non-consensual debts also include a judgment that a creditor has against you or a tax lien against the property since you didn’t pay your federal state or local taxes.

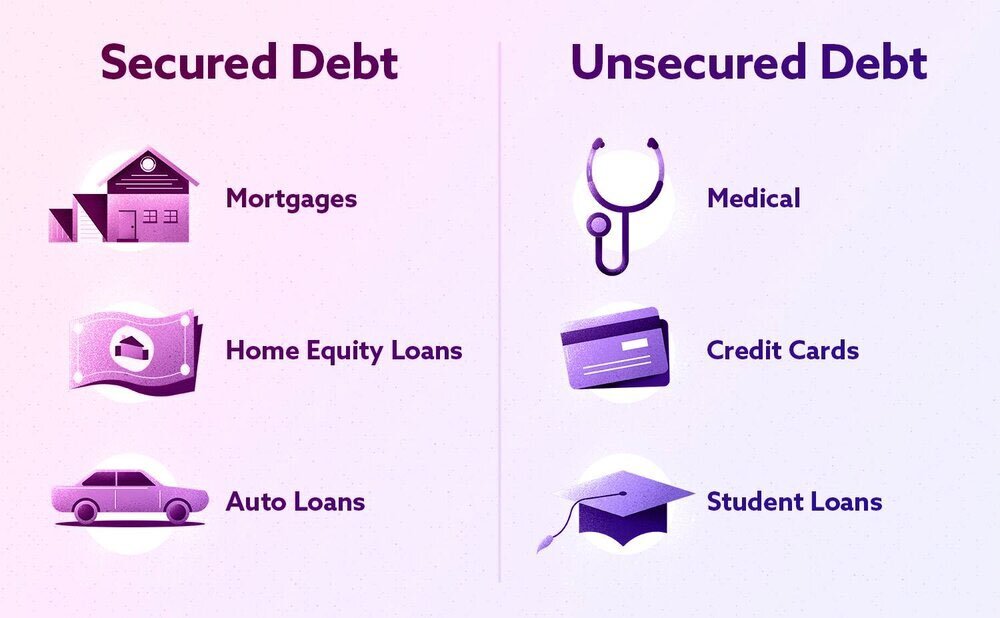

Examples of Secured Versus Unsecured Debt

When it comes to determining the difference between secured versus unsecured debt, consider if there is an item that is guaranteeing the loan. Secured debt includes a mortgage, car loan, or secured credit cards. The mortgage is secured by the home you are purchasing. The car loan is secured by the car you are purchasing. A secured credit card is secured by deposit money equal to the credit limit. If you don’t pay the bill then the lender just keeps your deposit.

If there isn’t anything of value then the debt is unsecured. Many kinds of unsecured debt include credit cards, personal loans, and medical debts. With credit cards, lenders aren’t able to come to your home and take back items you bought. With medical debts, the care provider isn’t able to take back the healthcare services you received.

The Interest Rates on Secured Versus Unsecured Debt

Secured versus unsecured debt will have differences in interest rates.

Secured Debts Will Typically Have Lower Interest Rates

For example, the interest rate on a mortgage is usually in the single digits, while the interest rate on a credit card is in the double digits. There is a reason why the interest rates are lower on secured debt and this is due to the lender’s risk. The chances that a secured debt not being repaid is much lower since the lender can sell the collateral if you don’t pay it back. There is a chance that the lender could lose money if the car or house doesn’t sell for as much as you owe but the risk is a lot lower since you typically do need a down payment. Below you can take a look at today's mortgage rates and see it for yourself:

With unsecured debt, there is a chance that the lender won’t get paid at all, especially if you file for bankruptcy. Even if you don’t file for bankruptcy, if you don’t pay the bill then the lender will have a legal battle in order to get the unpaid values and there is still no guarantee that they will get the money.

Approval for Secured Versus Unsecured Debt

Since there is collateral and the lenders have less risk, lenders can be more willing to approve you for secured loans instead of unsecured loans.

Credit Score Impact

You can get a secured credit card even if you don’t have the best credit. This is why many people get these types of credit cards when trying to rebuild credit after some financial problems. However, if you do have bad credit then you may be charged more for a secured loan than someone would with good credit. You may be required to put down a bigger down payment so the lender is even more protected.

Since you have a better chance of getting approved for secured debt this is also why many people take out car title loans, even though these are terrible. You can get approved for these loans even when other sources are not available and the car acts as collateral.

Your Risk Is Greater with Secured Debt

A lender may prefer secured debt since the chances of losing money are reduced. However, as a borrower, you take on the bigger risk if you agree to a secured loan. When you put your car or home up as collateral and end up not being able to pay, repossession and foreclosure are almost certain. The lender can sell your car or house in order to get their money back. On the off chance that the car or house sells for more than you owe with fees, you do get the difference.

However, if the car or home sells for just enough to repay the lender then you get nothing and you are without your car or house. In many cases, the car or house sells for less than you owe and the lender can also still pursue a claim against you in order to recoup any additional funds. Think before you turn unsecured debt, such as a personal loan or credit card, into a secured debt.

For example, if you are taking out a second mortgage to pay off this debt then you have your home as collateral. If you get into more financial trouble then you lose your home but you wouldn’t have this if you would have kept your cards.

We Can Help You Get Through Your Debts. Join Debtry.

Know the Difference Before You Borrow

One big debt tip is knowing the difference between secured versus unsecured debt before you borrow. Taking on a secured debt in some circumstances can make sense to many borrowers. If you are trying to build some credit and aren’t able to get a conventional card then a secured card can be the right tool to use in order for you to get a positive payment history.

If you want to get a car or a home then a secured loan can also make sense since the lower interest rate you will get makes the purchase more affordable. You also get tax breaks for mortgage interest rates that you wouldn’t get for other kinds of debt.

Make Sure You Will Be Able to Pay Your Bills on Time

Regardless of what kind of debt you are getting, you need to understand the risk before you borrow and be sure that you are confident you can pay the bills on time. You should not borrow any money, whether it's unsecured or secured unless you are sure you can pay back it back.

Prioritizing Secured Versus Unsecured Debts

If you are strapped for cash and are then faced with some hard decisions about paying for only some type of bills, it’s best to pay secured debts first. These payments are usually harder to catch up on and you can lose your essential assets if you fall behind on payments.

You may give more concern to unsecured debt if you are already making payments to pay off your debt. Unsecured debts may have higher interest rates, which will make them longer to pay off and will mean you need to pay more. Even when you are in debt repayment mode, you need to try to keep up with the minimum payments on all your accounts, whether it is secured or unsecured debt.

Can Bankruptcy Save You?

Bankruptcy can be a good option to resolve some unsecured debts. This erases the legal responsibility to repay the debt but it also impacts your credit score and chances of getting any loans in the future. Bankruptcy can be more complicated for secured debts.

Understanding Different Loan Types

With so many types of loans and debt you can acquire, it helps to know the different loan types and whether or not the types are secured or unsecured.

Personal Loans

Many banks offer personal loans and you can get the money you get from a personal loan for virtually anything. This is one of the most expensive ways to get money since the loan is unsecured. You can usually get a personal loan for a few hundred to a few thousand dollars with a repayment period ranging from two to five years.

In order to get a personal loan, you will need income verification. Even though the loan is unsecured, you still need to show proof of assets at least as much as being borrowed. You do get approval within a few days. A personal loan could be the best option for you if you need to borrow a small amount of money and you have the ability to repay it.

Credit Cards

Technically, every time you pay for something with your credit cards you are taking out a personal loan. If you pay the balance in full then no interest is charged. If there is debt that is remaining then interest is charged every month until you pay it off. Credit cards are also unsecured debt but the big difference between a personal loan and a credit card is revolving debt.

The card will have a set credit limit and you can continuously borrow money up to that limit and then repay it over time. A credit card is more convenient than personal loans but requires some more self-discipline. It doesn’t take long to apply for a credit card and you can get thousands of dollars for a credit limit if you have a great credit score.

Home Equity Loans

This is a type of secured debt where you are borrowing against the equity you have built up in your home. If you have already paid off half the mortgage then you can borrow half the value of the home. One big advantage of this type of loan is that the interest rate is much lower than a personal loan.

However, the interest on a home equity loan will only be tax deductible if the money is used to build, buy, or improve the home. Since it’s secured, if you aren’t paying it back you can lose the home but you are able to use the money from a home equity loan for any purpose, even if it’s not to improve the home.

Home Equity Line of Credit

This loan works like a credit card but the home is collateral and it's secured debt. This line of credit may be repaid, used, and reused for as long as the account will stay open, which is usually 10 to 20 years. Just like a regular home equity loan, the interest can also be tax-deductible. However, unlike the regular home equity loan, the interest rate isn’t set at the time the loan is approved. Since you may be getting money at any time over a period of years the interest rate is usually variable. This type of variable interest rate can be either good or bad. During a period of rising rates, an interest rate can increase.

For example, if you borrow money to upgrade your kitchen and pay it off over a period of years, you may get stuck paying more in interest than you expect since the rate goes up. The other potential downside is that the lines of credit can be large and the introductory rates are usually really attractive but it's easy to get in over your head.

Credit Card Cash Advances

Many credit cards have a cash advance option. Anyone who has a credit card can also have a revolving line of cash available at an ATM. While this is unsecured debt, this is a very expensive way to borrow money. The interest rate on a cash advance can range from 25% to 36% depending on your credit. Cash advances also come with a fee that can equal 3% to 5% of the advance amount.

Cash advances go into the credit card balance and will also accrue interest from month to month until it is paid off. Cash advances are also available from other sources. For example, tax preparation companies can offer advances against an IRS refund. Unless there is an emergency, there shouldn’t be a reason to give up part of the refund to get some money faster.

Secured Cards and Prepaid Cards

Both secured credit cards and prepaid cards require that you deposit money before you are able to use them. Both can be used in the same way and both are secured debt but there is some difference between the two cards.

Secured credit cards make you have a security deposit against the credit limit before you are approved for the card. This money is in a savings account and kept there until you convert the card to unsecured credit.

With a prepaid card, you don’t have to make monthly payments on time in order to avoid any credit damage or late penalties. There isn’t a credit check for a prepaid card so you aren’t turned down because of bad credit. A secured card is the best choice if you are improving your credit score. A prepaid card is sometimes the right choice for those who want to avoid banks or if you can’t get a checking account.

Final Thoughts

When taking out a loan, your credit history is going to determine whether or not you are going to be eligible for unsecured or secured debt. Unsecured loans may not be an option for you if you are just beginning to use credit or you don’t have the best credit history. Unsecured loans are subject to higher interest rates.

Paying off debts and paying off higher interest loans will help you reduce the credit utilization ratio to give your score a chance to grow. Knowing the difference between secured versus unsecured debt can also help you achieve financial success sooner and have the added benefits and security that you need to protect your assets.