A Mind-Melting Review of the Average Credit Card Debt

If you are looking for a mind-melting review of the average credit card debt, then you are in the right place. You may think, "There is no such thing as average credit card debt." You'd be surprised, but if you are struggling with credit card debt, then you are not alone.

What you learn here about average credit card debt may be a little mind-melting, but it is also important. By learning some statistics about average credit card debt, you can break from the mold and make yourself unique. Just because credit card debt is common does not mean that you have to subject yourself to it. Rise above credit card debt and take control of your finances.

Understanding Debt

Before we go into statistics on average credit card debt, it is good to understand debt a little better. In order to get a better understanding of the basics of debt, we will look at types of debt, as well as some tips to avoid getting into debt.

Types of Debt

Credit card debt is not the only type of debt out there. While the focus of this article is credit card debt, it is a good idea for you to get a basic understanding of the main types of debt out there. Chances are that if you are struggling with credit card debt, then you may be struggling with other types of debt. The main types of debt are:

- Credit Card Debt: I will not go into credit card debt here though, since it will be the main focus of the article.

- Student Loan Debt: According to Sallie Mae's Majoring in Money report, the majority of young adults have been shown to be fiscally responsible. Sallie Mae determined this based on things such as "paying bills on time, tracking their spending, and not spending more than they have". Despite this, many students find them in student loan debt after graduating from college. One reason for this is the ever-rising cost of tuition. You can find out more about student loan debt statistics here.

- Mortgage Loan Debt: While there are multiple types of household debt, mortgage loan debt makes up the greatest component of household debt. Average mortgage loan debt even hit a new high: at a whopping 11.92 trillion. Unfortunately, mortgage debt is a harder debt to cut out of your life: you need a home to live in. That being said, being smart and choosing a home that fits into your budget can make your mortgage loan debt lower than it otherwise would be.

- Auto Loan Debt: Similar to how everyone needs a home to live in, many Americans require a car to get to and from work. While auto loan debt only makes up 9,2% of consumer debt, that is still no small amount of debt. But also similar to mortgage loan debt, you can make your debt lower by being smart and doing a little extra work: do research on all of your options and choose a car -- preferably a used car rather than a new car -- that fits in your budget.

- Business Debt: If your dream is to be a small business owner, then you may have to watch out for small business debt. While a small business loan -- also known as a SBA (Small Business Administration) loan -- or traditional business loan could be the right option for you to build your business, make sure to borrow wisely. Don't borrow more just to borrow more. Now that you are a small business owner, your focus needs to be on profit. That means making decisions that increase income and decrease -- especially unnecessary -- expenses.

Tips to Avoid Debt

Some debt is unavoidable, but even debt that is unavoidable can in some cases be decreased. Remember the examples of mortgage loan debt and auto loan debt above: Even if you cannot avoid taking on that debt, you can make sure you take on less debt by making better, more informed decisions. Here are a few tips on how to avoid debt:

Stay Employed: One way to avoid debt is to hold a steady job. This is important because holding full-time employment and having a steady stream of income will make it less likely that you will find yourself in a situation where you cannot afford to make necessary payments and take care of your responsibilities. Not only does staying employed help you avoid debt, but it will also help you pay down any debt that you already have.

Emergency Fund: If you set up an emergency fund, then you will have money set aside for a rainy day -- or a stormy day, in the case of an emergency. An emergency fund can help you avoid debt in many instances. One such instance is if you have a medical emergency. If you have an unexpected medical emergency, then an emergency fund could help you afford your medical bills and avoid debt.. However, if you do not have an emergency fund in place, then you may need to get a personal medical loan to help get you back on your feet.

Live Within Your Means: If you live within means, then you will more often than not be able to avoid debt. However, if you do not live within your means and instead spend money on anything and everything you want, then you are more likely to fall into the debt trap. Create a budget and stick to it. (It doesn't help to have a budget if you don't follow it!) You can even build a budget on low income or even create a budget as a couple. The important thing is that you take a look at your finances and prioritize your spending, so that you do not waste too much money on unnecessary things and land yourself in debt.

Credit Card Debt Statistics

Before looking at average credit card debt, based on age and state, it makes sense to look at credit card statistics. Specifically, who has credit cards, how many credit cards, and for what reasons?

Most people have at least one credit card. The percentage of credit card holders increases among the younger population, especially among college students. According to Sallie Mae, "57% of college students, 83% of college students, and 61% of non-completers" have credit cards. While people in this age group have five credit cards on average, two credit cards more than the average in 2016. The use of these credit cards is also higher than the average credit card use in 2016, going up to an average balance of $1,183. The reason college students open and use credit cards was almost unanimous: to establish credit. This was true for 58% of college students, 74% of college graduates, and 77% of non-completers.”

And now, for the most interesting part: the review. We will cover the average credit card debt by age, state and income level. Remember, these numbers are just averages, they don’t mean anything else. They don’t determine how good or bad you are at managing your debt, but it can be interesting to see where you are in comparison with your peers.

Average Credit Card Debt By Age

Now let's look at the average credit card debt by age. While people like to give Millenials a hard time, they actually do not have the highest credit card debt - not by far. Consumers in their 20s only have an average of around $3000 in credit card debt, while the highest credit card debt belongs to consumers ages 41-56, at an average of $7,070. 98-year olds have the lowest average credit card debt, with consumers in their 90s holding an average of only $1,433 in credit card debt.

When you look at average credit card debt based on generation, Generation Z has the lowest average credit card debt, while Generation X has the highest average credit card debt. Here is average credit card debt by generation, with the age range for each generation designation:

- Generation Z ( those born between 1997 and 2012 ) - $2,876

- Generation Y ( Millennials; those born between 1981 and 1996 ) - $5,928

- Generation X ( those born between 1965 and 1980 ) - $7,004

- Baby Boomers ( those born between 1946 and 1964 ) - $6,785

While we like to look at younger generations as being more irresponsible, it makes sense that younger people will have lower credit card debt, since it takes time to accumulate debt. It also makes sense that the elderly would not have as high of credit card debt, since older people are less likely to take on newer trends, such as credit cards.

Average Credit Card Debt By State

To see how you compare to others in the state you live in, check out our list below, which has the average credit card debt by state:

| State | Credit Card Debt | State | Credit Card Debt |

|---|---|---|---|

| Alabama | $5,047 | Alaska | $6,617 |

| Arizona | $5,157 | Arkansas | $4,791 |

| California | $5,120 | Colorado | $5,541 |

| Connecticut | $6,040 | Delaware | $5,462 |

| District of Columbia | $5,671 | Florida | $5,623 |

| Georgia | $5,693 | Hawaii | $5,614 |

| Idaho | $4,582 | Illinois | $5,365 |

| Indiana | $4,651 | Iowa | $4,289 |

| Kansas | $5,063 | Kentucky | $4,521 |

| Louisiana | $5,127 | Maine | $4,676 |

| Maryland | $5,977 | Massachusetts | $5,141 |

| Michigan | $4,692 | Minnesota | $4,767 |

| Mississippi | $4,587 | Missouri | $4,950 |

| Montana | $4,785 | Nebraska | $4,819 |

| Nevada | $5,422 | New Hampshire | $5,327 |

| New Jersey | $5,978 | New Mexico | $4,948 |

| New York | $5,414 | North Carolina | $5,121 |

| North Dakota | $4,865 | Ohio | $4,888 |

| Oklahoma | $5,271 | Oregon | $4,681 |

| Pennsylvania | $5,080 | Rhode Island | $5,256 |

| South Carolina | $5,310 | South Dakota | $4,633 |

| Tennessee | $5,006 | Texas | $5,848 |

| Utah | $4,900 | Vermont | $4,653 |

| Virginia | $5,992 | Washington | $5,238 |

| West Virginia | $4,686 | Wisconsin | $4,376 |

| Wyoming | $5,182 |

While these are only averages, it is still interesting to see how average credit card debt differs from state to state. How do you fit into this average? Do you have more or less credit card debt than the average credit card debt from the state you reside in? It isn't a big deal if your credit card debt is much higher than the average credit card debt in your state. It is just good to be aware of where you place in the average, so that you know in which areas you could improve.

Average Credit Card Debt by Income Level

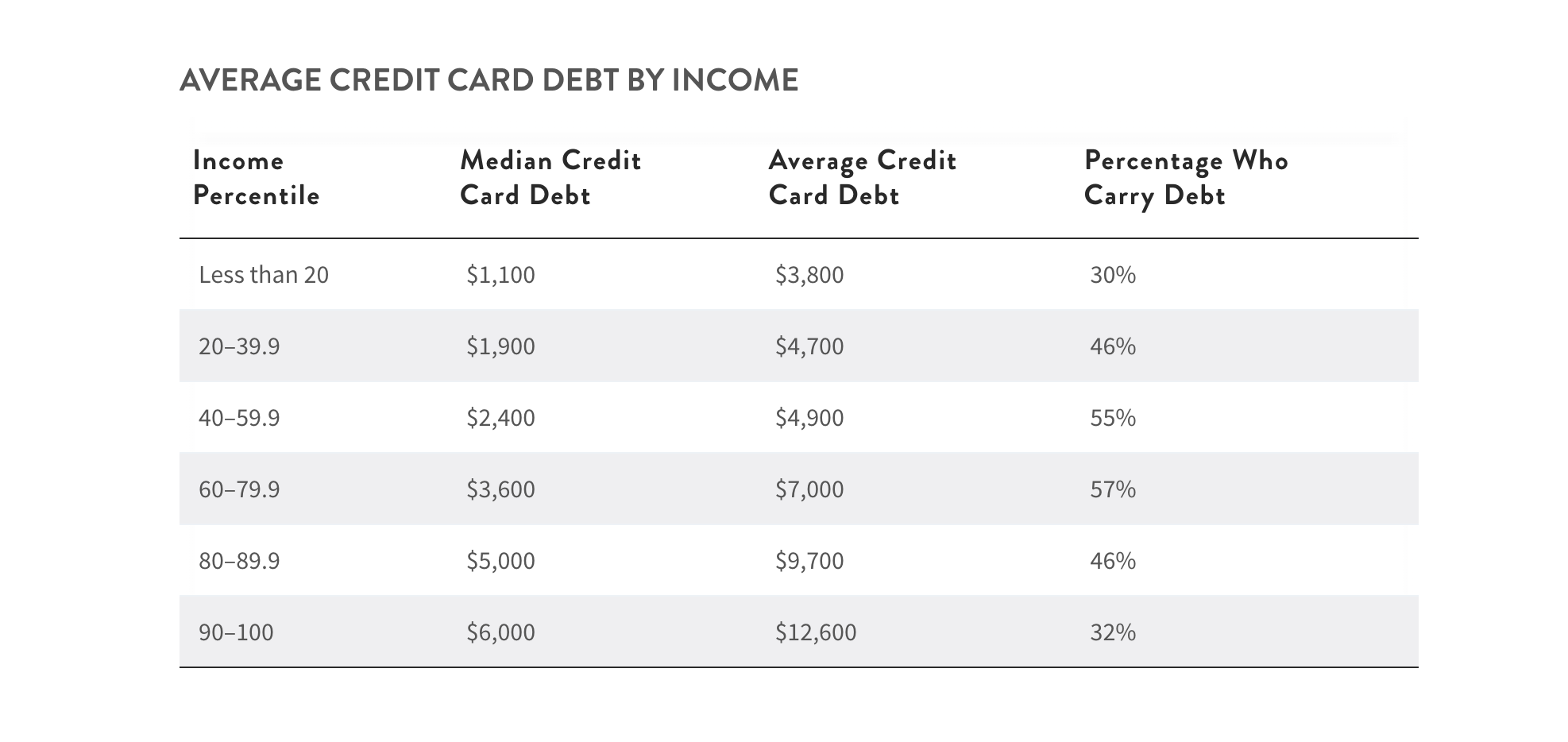

Differences in average credit card debt can even be found between those with different income levels. Here is average credit card debt by income level, with income given as annual income:

Image Source: MoneyGeek

Income level has a positive relationship with average credit card debt: As income level increases, average credit card debt also increases. Is the same true for you? Do you tend to spend more money when you earn more money, or do you rather charge more money to your credit cards when you have a lower income? While those with a higher income level tend to have a higher average credit card debt, it seems that people tend to spend more than what is available to them.

Getting Out of Credit Card Debt

The first step to getting out of credit card debt is to admit that you have a problem. Here are a few of the ways that you can find yourself drowning in credit card debt:

As I just mentioned, admitting that you have a problem is the first step to getting out of credit card debt. If you fail to come to terms with and continue to make excuses for your credit card debt, then you will just dig yourself into a larger and larger hole.

If you use your credit card for every purchase you make, then it can be easy to oversee how much you spend. If you do use credit cards for all of your purchases, make sure that you still track your spending, so that you can avoid credit card debt.

Sometimes being impulsive is a good thing. However, when you do not hold yourself to any rules or guidelines, then you can find yourself in trouble. Especially if there is a big-ticket item you are interested in buying, it is a good idea to follow the 3-day rule: Wait and think about the item you want to purchase (as well as its price), and if you still think it is a good idea to make the purchase after 3 days, then go for it. But more often than not, you will probably realize that it is not worth making the purchase after sleeping on it for 3 days.

Tips for Getting Out of Credit Card Debt

If you want to get rid of credit card debt, then here are some tips:

Make a credit card payoff plan. The first step to getting rid of credit card debt is to sit down, look at your debt, and make a credit card payoff plan for how you are planning to deal with your credit card debt.

Stick to your credit card payoff plan. If you make a plan, then stick to it. Make sure you set realistic goals, so that you will be more likely to achieve your goals. If you set goals that are unattainable, then you may become discouraged and give up.

Pay more than the minimum. While you should be making at least the minimum payments required each month, you would be better paying off more than just the minimum each month, if that is possible for you and your situation. If you pay even $10 more every month, you will pay off your debt that much faster.

Debt consolidation. Debt consolidation will not get rid of your credit card debt, but it will make it easier for you to manage. You may even be able to score a lower interest rate when you consolidate your debt, which will mean paying less back in unnecessary fees down the line.

Negotiate. You can negotiate almost anything down. Just like you can negotiate bills, you can also negotiate with credit card companies. You may be able to negotiate a smaller interest rate or a better payment plan. You never know if you don't ask.

Get help. You do not have to deal with this on your own. If you need some assistance in figuring out how to get rid of your credit card debt, then don't be afraid to ask for help. Debt management could be the answer to your problems.

Learn All About Your Debt

Conclusion

Now that you know some statistics on average credit card debt, maybe you will be able to look at the bigger picture of your own debt. You should not be embarrassed if you have credit card debt, since -- as you can see - it really seems to be the norm. That being said, now that you know how average credit card debt is, you can begin to work towards cutting down on your own credit card debt and reaching your own financial goals. You can do this!