US Debt Statistics Told By We the People

Four times a year, the Federal Reserve Bank of New York, one of the twelve regional Federal Reserve Banks making up “The Fed” (along with their Board of Governors in Washington, D.C.), issues a report on the nation’s economy. Several reports, actually, including one focused on household debt across the country. These are some of the most valuable sources we have regarding U.S. debt statistics, and while they can seem a bit overwhelming at times, there’s much worth noticing in these reports.

As you might imagine, these reports get a great deal of attention from financial analysts, who spend many hours digging through them and arguing the specifics with one another. You’ll be relieved to know that’s not what we’re going to do here. Instead, I thought we’d look at a few highlights and talk about the parts which have the potential to impact folks like you and me most directly.

The report opens with discouraging news:

Aggregate household debt balances ticked up in the fourth quarter of 2022, increasing by $394 billion (2.4%) to $16.90 Trillion (7.8%). Balances now stand $2.75 trillion higher than at the end of 2019, before the pandemic recession.

Source: https://www.newyorkfed.orgIn English, that means our total personal debt keeps creeping up, as it has every quarter for the past five years. At the moment, we’re nearly $1 trillion more in debt than we were in the first quarter of 2022. For every $100 we owed around Easter of that year, we owe $122.50 six short years later.

And keep in mind that these U.S. debt statistics refer to consumer debt, money owed by people, rather than business debt, owed by institutions. In other words, Americans have a problem with debt.

We Can Help You Get Through Your Debts. Join Debtry.

Housing and Mortgages

Note: Technically, a mortgage is any debt with an established repayment plan and secured by real estate. If you default on the repayment, the lender has a claim on the property. It’s the most common type of home loan, but it can also refer to other loans secured by the property. A home loan, not surprisingly, is any loan for the purpose of purchasing a home. Most home loans are mortgages, and most mortgages are home loans. For our purposes here, discussing U.S. debt statistics, they’ll be used interchangeably.

As of the end of the fourth quarter of 2022, Americans owed $11.92 trillion on our collective mortgages, a relatively mild increase of nearly $1 trillion in mortgage balances in 2022. New mortgage approvals slowed significantly, although it’s too early to know for certain whether this is a new pattern.

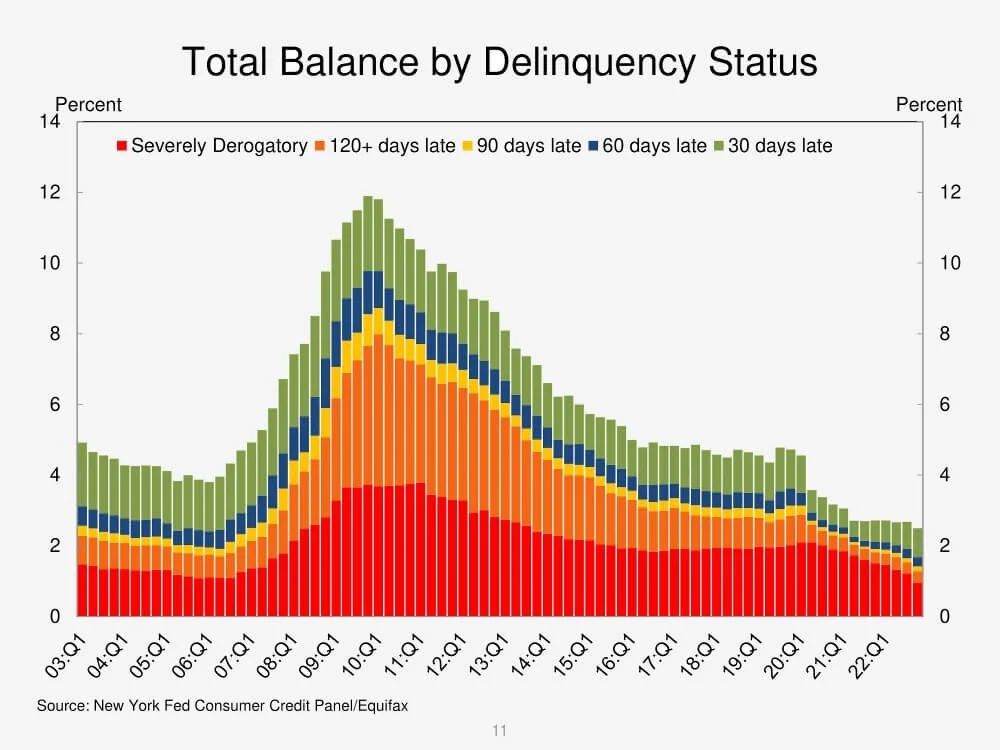

The rate of delinquencies slightly increased by 0.6 for credit cards and 0.4 percentage points for auto loans.

In any case, as you can see from the graph below, over 2/3 of our total household debt in the U.S. is for our homes, which by itself is perhaps not such a surprise. It’s just that nothing else even comes close when it comes to total dollars owed, but as of yet unpaid.

We talked about mortgages and some of the ins and outs of securing decent mortgage loan terms not that long ago. It’s worth revisiting in full, but for now, here are a few highlights:

First, your home is collateral

On the one hand, this makes it slightly easier to get approved for a home loan at a decent rate. On the other, it means the lending institution has a very real claim on your home if you don’t keep up with your payments. They don’t want it, you understand… repossessed homes aren’t how banks like to make money, and there’s no guarantee they’ll recoup what they’d hoped to get from you over the years. Still, if necessary, it’s the leverage they will use – if for no other reason than to encourage the next guy to keep up with his payments.

Second, interest rates matter

Interest rates always matter, but on mortgages, they matter a LOT. A large amount of money usually in play, combined with terms of fifteen or thirty years, makes every fraction of a percentage point significant.

The principal is the part of each payment that goes to the actual cost of the home. Most mortgages are set up so they’re paying mostly interest at first, and over time begin to pay more and more towards the principal.

Third, those interest rates (the ones that matter) are fairly low at the moment

If your mortgage still has a decade or more left, and you’re paying significantly more than today’s rates (at the moment, they’re hovering around 4%), you might save yourself a great deal of money by refinancing. There will be closing costs and such up front, so you’ll want to do some math and see how it looks, but it’s an option many Americans have pursued in the past few years.

Many people will take out home equity loans as well, borrowing for other purposes but securing those loans with their homes. As with any loan, shop around for terms and best interest rates, and make sure you can reasonably repay the amount borrowed according to the agreed upon terms without dramatic sacrifices or miraculous intervention. IT’S YOUR HOUSE, after all.

Fourth, it’s hard to tell what housing prices are going to do

Since 2010, average housing prices have risen, albeit inconsistently. Changes vary dramatically from region to region and price range to price range, complicated by shifts in how large new homes tend to be and what sorts of features or technologies are becoming standard for some populations. Housing prices also respond to the economy as a whole, sometimes to reality and often to perceptions, hopes, or fears. One good year of employment or one reckless tweet and the averages can skyrocket or plummet without warning.

What does this mean for you? It means buy a home you really want at a price and on terms you can really afford. The trends and predictions will have to take care of themselves. We look at U.S. debt statistics for our own enlightenment. We’re only in charge of us.

Student Loans

As you’re probably aware, student loans are another major source of debt across the U.S. According to the New York Fed, outstanding student loan debt increased by $21 billion between the third and fourth quarter of 2022, to $1.6 trillion.

Not only are more people in debt with student loans, but the amounts are increasing. According to a recent report by CNBC,

The average college graduate leaves school $37,000 in the red today, up from $10,000 in the 1990s. Yet much larger balances are becoming more common.

About 10% of graduate students owed more than $100,000 in 2022. 48.9% of students who borrow money to attend school are still paying off loans 20 years later.

This is a hot political topic at the moment, with several top Democratic candidates promising to eliminate some or all student debt if elected. Because of the unusual scope and scale of such proposals, it’s not entirely clear what the long-term unintended consequences (positives as well as negatives) might be.

Obviously, if you have substantial student debt, you should pay attention to these discussions and plans, but they’re not a good reason to ignore your current obligations – especially if you’re already having trouble keeping up.

Look over your options. One, of course, is to keep doing what you’re doing. Another is to explore some sort of bill consolidation loan, or student loan refinancing. (Yes, that’s a thing.) Make sure you’re not missing out on any loan forgiveness options which you may not have thought about in a while. Separate the facts from what your friend from work swears she saw on Facebook.

With the student finance tools and resources available today, you’re the single greatest factor in charting a financial course forward.

Auto Loans

Auto loan statistics is another one we’ve talked about recently. We need somewhere to live, and most of us love our homes, but there are few things more American than a person’s relationship with their car or truck. It’s actually kinda weird if we’re being completely honest about it.

I’m not here to judge, you understand. It’s just that U.S. debt statistics suggest that sometimes the emotional connection we feel to the “right” car or truck impedes our judgment about appropriate pricing, financing, or other logistics which are far less sexy and not at all emotionally satisfying. Let’s recap the highlights:

First, more people are borrowing more money to purchase more vehicles

No surprise here, given the larger trends. The number of Americans borrowing money to purchase a car or truck keeps rising. Auto loan balances increased by $10 billion in the first quarter of 2023. The volume of new auto loans is still above what it was for the same quarter a year ago and the overall amount of money being borrowed for car and truck purchases continues to rise, suggesting we’re buying somewhat more expensive vehicles on average.

Second, vehicle loans with shaky credit are growing slightly harder to get

Auto loans are still easier to get compared to most other forms of credit, even for people with less-than-stellar credit histories, but lenders are gradually demanding higher scores than they used to, even for auto loans. (While it may or may not be directly related, the number of auto loans hitting 90 days or more behind continues to inch up as well.)

This doesn’t mean it’s impossible to get an auto loan with bad credit, but you’ll have to shop around a bit harder and might have to pay a higher interest rate. Don’t get desperate, though, and definitely don’t get reckless. You don’t have to sign over your firstborn or commit your soul to some dark spiritual force to secure a reliable ride to work and the grocery store. You also don’t have to risk buying a sketchy vehicle from an even sketchier dealer. It’s the 21st century – look at your options and go with a legit lender with verifiable business history. One of the most overlooked U.S. debt statistics is that we have more control than ever before about exactly who we choose to auto finance from.

Third, be realistic about any new (including new-to-you) vehicle purchases

Do you really need a car? And if you do, does it really have to be that car? With those features? In that color?

If money is no object, then go for it. Have a good time. Although, if money is no object, why are you reading this (other than for my obvious wit and charm)? I’m not suggesting you can’t find a way to buy a car or truck that will do what you need it to do. I am suggesting that you’ll want to consider your options a bit more carefully than you would have a decade or so ago.

I’m suggesting you do more preparation in terms of auto loan options and your personal budgeting for monthly payments. There are lenders who will approve you for far more than you can realistically pay because the numbers look good on paper.

You know what doesn’t look good on paper? Delinquency notices because you don’t live on paper. You live in the real world, for better and worse. Utilize online loan calculators and secure pre-approval before car shopping.

Fourth, lower your long-term commitment by making a down payment

On the one hand, if you don’t have it, you don’t have it. And it’s not a good idea to completely empty out your savings, even if it would lower your car payment by a hundred bucks a month or whatever. But if you can afford even 10% down on a new car or truck purchase, it can be a game-changer in terms of your monthly payments. It might even help you negotiate a lower interest rate to begin with.

You know how you find that out? You ask and keep asking. Any lender not willing to answer your questions doesn’t deserve your business. Period.

Credit Card Debt

In the fourth quarter of 2022, credit card balances increased by $61 billion, and now it is $986 billion.

That’s right – we’re paying down our credit cards, at least collectively. Credit card limits continued to rise, possibly as a result of so many people making their payments. At the same time, the rate at which 30 – 60 day delinquencies are becoming 90+ day delinquencies continued to increase in the first three months of 2019, a pattern that has been constant since early 2017.

In other words, U.S. debt statistics about credit card debt are a bit more mixed. We’re seeing action on both ends of the spectrum. More people are paying down (or off) their cards, while on the other extreme more people are getting further and further behind. If you’re somewhere in the middle – never seriously late but never quite getting that balance under control – then we should revisit the credit card statistics we talked about.

Flow into Serious Delinquency (90 days or more delinquent)

| CATEGORY | Q4 2021 | Q4 2022 |

|---|---|---|

| CREDIT CARD DEBT | 3.2% | 4.01% |

This piece is supposed to be about debt statistics. And it is. But more than any other type of debt, credit cards are personal. They can be a blessing or a curse, and often both at once. The good folks over at The Street have taken some time to review stats about credit card use and credit card debt in detail. Feel free to check them out.

At the risk of badgering you, however, I’m going to stick to a few basics. If you’re anything like me, a little repetition is often just the thing. Besides, if you’re anything like me, a little repetition is somethings just the thing. (See what I did there?)

First, credit cards offer flexibility and freedom

That is, in fact, their best feature and their most destructive curse. They allow us to impulse buy, but they also allow us to handle unexpected circumstances with a little grace. They encourage us to spend beyond our means, but they allow us to pay for major purchases over time without making special arrangements in advance. They’re designed to keep us in perpetual debt, but they reward us endlessly for paying even token amounts on a regular basis. The freer they make us feel, the more bondage they can bring; and yet, used responsibly, they’re the most practical form of currency in the history of mankind.

Also, you can get them in cool designs, with team logos or pictures of bunnies or whatever you’re into. That really shouldn’t be a factor, but… bunnies!

If you are interested to get a credit card, check some options here:

Second, responsible credit card use is like responsible diet and exercise

You can eat well 23 hours a day and still be overweight because of the remaining 60 minutes. You can spend responsibly 29 days a month and still end up in trouble with your cards.

Diet experts suggest various “tricks” to help us eat more responsibly. You know – put your fork down between each bite, use a smaller plate, stop as soon as you’re not hungry, don’t keep junk around the house where it’s easy to grab, drink more water so you feel full, etc. If your cards have been naughty at times, consider similar “tricks.”

Leave them at home, locked up in a safe or desk drawer, so you can access them when necessary, but it’s difficult to “impulse buy.” Write a note to yourself about financial goals or the benefits of lowering your debt and wrap it around the physical card, whether it’s in your wallet, purse, desk, or safe. Read it every time you want to use the card. If you use your credit cards online, skip the option to let websites save your info for easy checkout. We don’t want it to be easy to checkout! We want to have to unlock the safe and read the note first!

Third, your minimum payment should never be your minimum payment

The minimum payment due on that monthly statement is usually just enough for the issuing company to keep charging you interest without any danger of you paying off the card in full. We can debate whether or not that’s mean or unfair or evil, but it doesn’t really matter. In the end, that’s capitalism. We benefit from it a LOT in our daily lives, but we also have to recognize the tricky parts.

Minimum payments due on your plastic each month? Those are some of the tricky parts. Pay more, or don’t use the cards so much.

Fourth, interest rates and other terms aren’t set in stone

If you’re not happy with the rates you pay or the fees your card charges, shop around for better. You’d be surprised how flexible lenders can be once you let them know you’re transferring your business to someone with a better deal.

Start Avoiding More Personal Debts

It matters what everyone else’s debt is doing. Their collective choices and the results of their efforts impact you and me whether we want it to or not. Most days, though, all we can do is try to make informed financial choices for ourselves based on what we see. That’s why you’re reading about U.S. debt statistics. Assuming you’re not taking an economics class (and if you are, you don’t need me), you’ve decided to make more informed choices. That puts you ahead of the pack, my friend – way ahead.

Maybe it’s time to refinance a house or a student loan. Maybe it’s time to switch to a lower-interest credit card. Maybe it’s time to get serious about a household budget, start utilizing a personal debt tracker, and avoid more personal debt to begin with. All of that’s up to you. What we do is try to help connect you with financial professionals you might find useful for whatever you decide. It’s up to you where to go from there.

Surveys suggest a majority of Americans are optimistic about their personal economic situation and the labor market in the near future. They feel good about the direction things are going in terms of wages and lower unemployment. Polls about “optimism” don’t measure hard numbers or real dollars, of course – such stats are about feelings and perceptions – but when it comes to the economy, optimism can be self-fulfilling.

If Stan thinks it’s OK to invest because the stock market is about to go up, he invests. If thousands of others feel like Stan, they invest as well, and as a result, the stock market goes up, making all of them correct. This happens throughout the economy in all sorts of ways.

In Conclusion

If the economy is moving in a good direction, that makes this a good time to lower your personal overall debt. If your paycheck is going up, this is a great time to zero in on balance reduction, on seeking out lower interest rates and better terms. You may shoot for debt free living, or you might be happy just to have things under control. If times really are good and getting better, let’s ride that towards a better household economic situation.

If, on the other hand, the majority of those surveyed are wrong… if the economy is actually shakier than it looks, then this is a good time to lower your overall personal debt. If your job might be in danger, this is a great time to zero in on balance reduction and to seek out lower interest rates and better terms. Maybe debt free living isn’t on the table, but you can get things under control. If times really are as dark as they sometimes feel, let’s prepare for whatever’s ahead by getting serious about our household economic situation.

And if things are actually going to stay pretty much like they are now for the foreseeable future, minus whatever little adjustments naturally take place here and there, then guess what? This is a good time to lower your personal overall debt. It’s a good time to zero in on balance reduction and to seek out lower interest rates. If this is how things are, let’s accept that and figure out what it means for securing a better household economic situation.